The internet is changing the way we do business, but with the wealth of opportunities comes an expanding array of risks that your general business liability policy doesn’t cover. Internet liability insurance, also known as cyber insurance, could help protect you against lawsuits related to intellectual property, data breaches, server outages, business interruption due to hackers or viruses, and more. Every business has something to protect with internet liability insurance, and much more to lose if they continue operating with only general liability coverage.

Who Needs Internet Liability Insurance?

It’s a common misconception that only tech companies need internet liability insurance. In fact, any company that uses the internet should have an internet liability insurance policy. If you have a website, or even simply utilize email for business communications, you’re vulnerable to lawsuits that standard business policies don’t cover.

Haven’t heard of internet liability insurance? You’re not alone. Many businesses have been slow to realize that they are facing new threats, and that there’s an insurance coverage that can help them avoid costly lawsuits or even bankruptcy. A 2009 report compiled by the FBI and Computer Security Institute (CSI) concluded that 70% of American businesses lacked financial stability due to their susceptibility to internet-related attacks and their subsequent legal proceedings. Since that report, internet technologies have become even more widely adopted, and the dangers for companies without internet liability insurance have grown.

Incidents Internet Liability Insurance May Cover That General E&O Won’t

Intellectual Property Rights (IPR) Issues:

Due to misunderstandings about the nature of copyright on the internet, many websites are using images or text, without permission, in their digital and printed material. Using copyrighted material without explicit permission or correct attribution is illegal, and you may have to pay hefty fees to avoid serious legal problems. Internet liability insurance could help dissuade frivolous suits from individuals or companies looking to make a quick buck, and can even pay a portion of the damages if the case is taken that far.

Privacy Breaches:

In the information era, customer data is currency. Similar to more tangible assets, customer information must be protected. Individual states are starting to pass laws regarding what a company must do if client data is exposed, and lawsuits claiming for millions, even billions of dollars are being filed. Whether the data breach is intentional or not, the outcome can be catastrophic. Internet liability insurance could mitigate the damage of such an incident, greatly increasing the likelihood your business could weather such a storm.

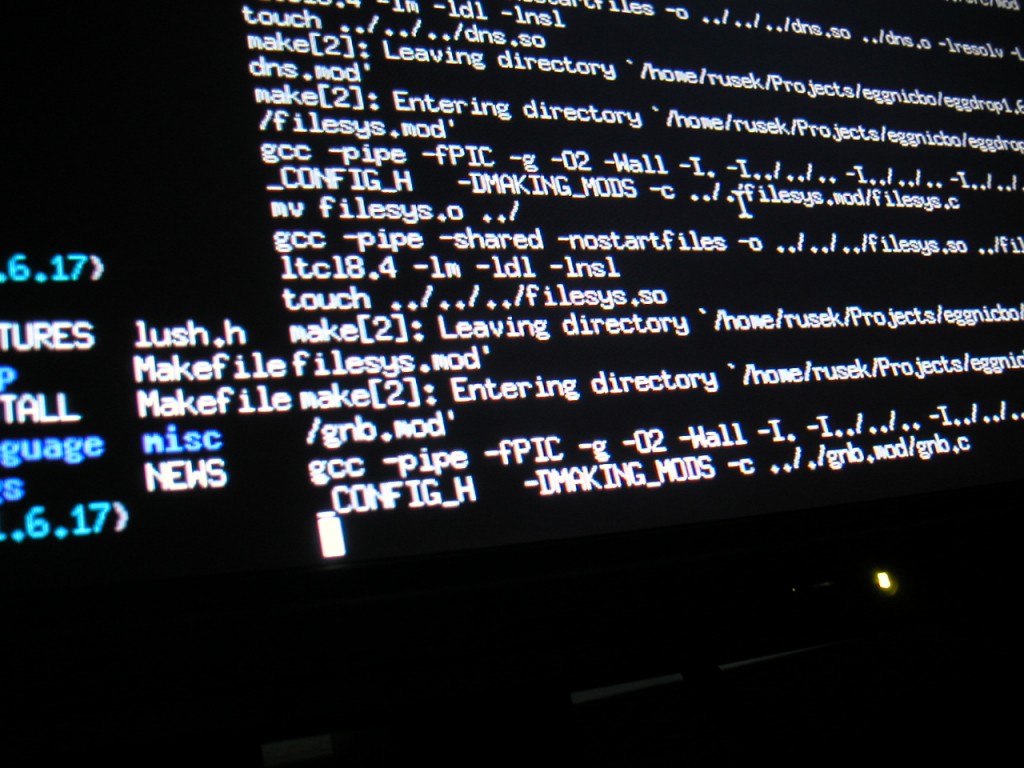

Cyberattacks:

The 2011 Global Economic Crime Survey by PwC (PricewaterhouseCoopers) contains some sobering statistics regarding the effect of cyberattacks on small businesses. The amount of cyberattacks is on the rise – 40% of companies were affected, making it the second most common economic crime – and the costs of such attacks are skyrocketing. “Cybercrime has emerged as a formidable threat, thanks to deeply determined, highly skilled and well-organized cybercriminals, from nation states to hacktivists, from criminal gangs to lone-wolf perpetrators,” stated PwC forensic accounting expert Didier Lavion. “Organizations need to be aware, and adjust to this changing landscape.”

Getting internet liability insurance from InsuringTech.com is the best place to start. It’s not just another insurance policy, it’s an investment in your company’s future.

Contact InsuringTech.com today to get a internet liability insurance policy that meets your needs!